Privacy Policy

Effective date: October 1, 2025.

Please retain a duplicate copy of this Privacy Policy for your records.

California Notice at Collection: If you are a California resident, see the California Privacy Rights Notice section for important information about your rights under California law.

Who We Are

DriveWealth, LLC and our subsidiaries and affiliates ("DriveWealth," "we", “us” or "our") provides a global B2B technology (including Brokerage-as-a-Service) platform (“Platform”) to develop everything from traditional investment workflows to more innovative techniques such as rounding up purchases into fractional share ownership. In order to provide the Platform, DriveWealth offers two integration options to its business customers (each an “Introducing Firm”):

“Fully Disclosed” wherein individual accounts are held by us in the names of the Introducing Firm’s customers (i.e., there is a direct relationship between DriveWealth and the end customer); and

“Omnibus” wherein an Introducing Firm has one trading account with us for all their customers and DriveWealth does not have visibility over those individual customers (i.e., there is no direct relationship between DriveWealth and the end customer).

What This Privacy Policy Covers

This Privacy Policy describes how DriveWealth processes personal information that we collect through (i) our websites that link to this Privacy Policy, including without limitation https://www.drivewealth.com/ (the “Site”), (ii) our other digital or online properties, domains or services that link to this Privacy Policy, including the Platform, (iii) associated marketing activities, (iv) social media pages, and (v) any other activities described in this Privacy Policy. DriveWealth may provide additional or supplemental privacy policies to individuals for specific products or services that we offer at the time we collect personal information.

In some instances, we act as a processor on behalf of Introducing Firms (such as banks, broker dealers, asset managers, digital wallets, and consumer brands) while providing the Platform (for example, where we have access to personal information in the Omnibus integration). This Privacy Policy does not apply to information that we process on behalf of such customers while providing the Platform. Our use of information that we process on behalf of Introducing Firms in these circumstances is governed by our agreements with such Introducing Firms. If you have concerns regarding your personal information that we process on behalf of an Introducing Firm, please direct your concerns to that Introducing Firm.

Gramm-Leach-Bliley Act (“GLBA”): Information we collect from U.S. customers who have created an account for purposes of seeking financial products or services from us to be used primarily for personal, family or household purposes is also subject to our U.S. Consumer Privacy Notice, available here. To the extent this Privacy Policy conflicts with our U.S. Consumer Privacy Notice, our U.S. Consumer Privacy Notice shall apply.

Notice to European Users: Please see the Notice to European Users section for additional information for individuals located in the European Economic Area or United Kingdom (which we refer to as “Europe,” and “European” should be understood accordingly) below.

Index

Personal information we collect

How we use your personal information

How we share your personal information

Changes to this Privacy Policy

California Privacy Rights Notice

Personal information we collect

Information you provide to us. Personal information you may provide to us through the Site and/or Platform or otherwise includes:

Contact data, such as your first and last name, email address, mailing addresses, phone number, and any Introducing Firm you work for, along with your role/title and powers of attorney to represent the Introducing Firm.

Communications data based on any exchanges with you, including when you contact us through the Site, social media, or otherwise.

Marketing data, such as your preferences for receiving our marketing communications and details about your engagement with them. For example, we may collect personal information from representatives at our Introducing Firms about their marketing preferences and their engagement with our marketing communications.

Analytics data, such as statistical demographic or event-based analytics based on your use of the Site and/or Platform.

Authentication data, such as information necessary to verify that you are a valid authorized user of the Platform and to manage your access to the Platform.

Investment data, such as information relating to transactions which are conducted in connection with your account on the Platform, including trades, deposits and withdrawals.

Financial data, such as your stated income, economic standing, and financial account numbers.

Taxation data, such as tax residency certificates and proof-of-address documents.

Government-issued identification number data, such as national identification number (e.g., Social Security number, tax identification number, passport number), state or local identification number (e.g., driver’s license or state ID number), and an image of the relevant identification card.

Custodial account and authorized user data that you provide in connection with establishing a custodial account or adding an authorized user to the Platform, such as date of birth or government-issued identification number of authorized user.

Other data not specifically listed here, which we will use as described in this Privacy Policy or as otherwise disclosed at the time of collection.

Third-party sources. We may combine personal information we receive from you with personal information we obtain from other sources, such as:

Identity verification services, such as background check providers and credit bureaus.

Public sources, such as government agencies, public records, social media platforms, and other publicly available sources.

Private sources, such as data providers, social media platforms and data licensors.

Marketing partners, such as joint marketing partners.

Automatic data collection. We, our service providers, and our business partners may automatically log information about you, your computer or mobile device, and your interaction over time with the Site and/or Platform, our communications and other online services, such as:

Device data, such as your computer or mobile device’s internet protocol (IP) address, browser type and version, time zone setting and location, general location information such as city, state or geographic area, browser plug-in types and versions, operating system and platform and other technology on the devices you use to access the Site and/or Platform.

Online activity data, such as pages or screens you viewed or actions you take while visiting our Site and/or Platform, how long you spent on a page or screen, the website you visited before browsing to the Site and/or Platform, access times and duration of access, and whether you have opened our emails or clicked links within them.

Communication interaction data such as your interactions with our email, text or other communications (e.g., whether you open and/or forward emails) – we may do this through use of pixel tags (which are also known as clear GIFs), which may be embedded invisibly in our emails.

Cookies. Some of the automatic collection described above is facilitated by cookies and similar technologies – for example, we may store a record of your preferences in respect of the use of these technologies in connection with the Site and/or Platform. For more information, see our Cookie Notice.

How we use your personal information

We may use your personal information for the following purposes or as otherwise described at the time of collection:

Site operation. To provide, operate and secure our Site and to operate our business.

Platform operation. To provide, operate and secure the Platform and to operate our business – including managing access and use of the Platform, allowing us to perform our agreements with Introducing Firms, securing the operation of and access to the Platform, and complying with relevant obligations under applicable laws, such as ‘Know Your Customer’ and Anti-Money Laundering requirements.

Improvement and analytics. To develop new programs, understand and analyze aggregated metrics, such as the number of visitors or page views, to analyze your usage of our Site and Platform, and to improve the Site and Platform.

Administration of our business and organization. To manage and operate our business and organization and planning activities, including to analyze, adapt, and improve our organization.

Dealing with your contacts with us. To provide information to you or otherwise communicate with you, including dealing with any issues arising from such contacts.

Marketing and advertising. We, our service providers, and our third-party advertising partners may collect and use your personal information for marketing and advertising purposes:

Direct marketing. We may send you direct marketing communications and may personalize these messages based on your needs and interests. For example, we may send representatives of our Introducing Firms certain direct marketing communications. You may opt-out of our marketing communications as described in the Opt-out of marketing section below.

Interest-based advertising. Our third-party advertising partners may use cookies and similar technologies to collect information about your interaction with the Site (including the data described in the automatic data collection section above), our communications and other online services over time, and use that information to serve online ads that they think will interest you. This is called interest-based advertising. We may also share information about you with these companies to facilitate interest-based advertising to you or others on other online platforms. You can learn more about your choices for limiting interest-based advertising in our Cookie Notice.

Research and development. We may use your personal information for research and development purposes, including to analyze and improve the Site and/or Platform and our business and to develop new products and services. As part of these activities, we may create aggregated, de-identified and/or anonymized data from personal information we collect. We make personal information into de-identified or anonymized data by removing information that makes the data personally identifiable to you, and, where required by applicable law, we will not attempt to reidentify any such data. We may use this aggregated, de-identified or otherwise anonymized data and share it with third parties for our lawful business purposes, including to analyze and improve the Site and/or Platform and promote our business.

Compliance and protection. We may use your personal information to:

comply with applicable laws, lawful requests, and legal process, such as to respond to subpoenas, investigations, or requests from government authorities;

protect our, your or others’ rights, privacy, safety, or property (including by making and defending legal claims);

audit our internal processes for compliance with legal and contractual requirements or our internal policies;

enforce the terms and conditions that govern the Site and/or Platform; and

prevent, identify, investigate, and deter fraudulent, harmful, unauthorized, unethical, or illegal activity, including cyberattacks and identity theft.

Data sharing in the context of corporate transactions. We may share certain personal information in the context of actual or prospective corporate transactions – for more information, see the reference to sharing with ‘Business transferees’ in the section ‘How we share your personal information,’ below.

Further uses. We may use your personal information for further uses. We only do this when those further uses are compatible with the initial purpose for which the personal information was collected, or with your consent.

Cookies and similar technologies. In addition to the other uses included in this section, we may use Cookies and similar technologies. For more information, see our Cookie Notice.

How we share your personal information

We may share your personal information with the following parties and as otherwise described in this Privacy Policy, in other applicable notices, or at the time of collection.

Affiliates. Our corporate parent, subsidiaries, and affiliates.

Introducing Firms. Introducing Firms using our Platform may need us to share certain personal information about authorized Platform users who are engaged by such Introducing Firms (e.g., where needed to do so).

Authorities and others. Law enforcement, government authorities, and private parties, as we believe in good faith to be necessary or appropriate for the Compliance and protection purposes described above.

Security providers. Third-parties who protect the security of our Site and the Platform.

Service providers. Third parties that provide services on our behalf or help us operate the Site and/or Platform or our business (such as hosting, information technology, customer support, email delivery, financial analytics).

Connected accounts. Where you use our Platform to access your accounts on any third-party websites, platforms, or applications, depending on the nature of the integration and authentication process (at your direction) we may share certain personal data with those third parties.

Advertising partners. Third-party advertising companies for the interest-based advertising purposes described above.

Third parties designated by you. We may share your personal information with third parties where you have instructed us or provided your consent to do so. For example, we may share your personal information with third-party advertisers with whom we are collaborating to offer you additional services. We will share personal information that is needed for these other companies to provide the services that you have requested.

Partners. We may share your personal information with our partners who use our Platform, for example, execution management system providers like Bloomberg EMSX, LSEG Autex and TRAFiX. For information on how these partners process your personal information, please view their privacy policies.

Business and marketing partners. Third parties with whom we jointly offer products or services, or whose products or services may be of interest to you.

Professional advisors. Professional advisors, such as lawyers, auditors, bankers and insurers, where necessary in the course of the professional services that they render to us.

Business transferees. We may disclose personal information in the context of actual or prospective business transactions (e.g., investments in DriveWealth, financing of DriveWealth, public stock offerings, or the sale, transfer or merger of all or part of our business, assets or shares), for example, we may need to share certain personal information with prospective counterparties and their advisers. We may also disclose your personal information to an acquirer, successor, or assignee of DriveWealth as part of any merger, acquisition, sale of assets, or similar transaction, and/or in the event of an insolvency, bankruptcy, or receivership in which personal information is transferred to one or more third parties as one of our business assets.

Your choices

In this section, we describe the rights and choices available to all users. Users who are located in Europe or California can find additional information about their rights below.

Access or update your information. If you have registered for an account with us, you may review and update certain account information by logging into the account.

Opt-out of communications. You may opt-out of marketing-related emails by following the opt-out or unsubscribe instructions at the bottom of the email, or by contacting us. Please note that if you choose to opt-out of marketing-related emails, you may continue to receive service-related and other non-marketing emails.

Cookies. For more information about cookies and similar technologies employed by the Site and/or Platform and how to manage your preferences, see our Cookie Notice.

Blocking images/clear gifs: Most browsers and devices allow you to configure your device to prevent images from loading. To do this, follow the instructions in your particular browser or device settings.

Do Not Track. Some Internet browsers may be configured to send “Do Not Track” signals to the online services that you visit. We currently do not respond to “Do Not Track” signals. To find out more about “Do Not Track,” please visit http://www.allaboutdnt.com.

Declining to provide information. We need to collect personal information to provide certain services. If you do not provide the information we identify as required or mandatory, we may not be able to provide those services.

Other sites and services

The Site and/or Platform may contain links to websites, mobile applications, and other online services operated by third parties. In addition, our content may be integrated into web pages or other online services that are not associated with us. These links and integrations are not an endorsement of, or representation that we are affiliated with, any third party. We do not control websites, mobile applications or online services operated by third parties, and we are not responsible for their actions. We encourage you to read the privacy policies of the other websites, mobile applications, and online services you use.

Security

We employ technical, organizational, and physical safeguards designed to protect the personal information we collect. However, security risk is inherent in all internet and information technologies, and we cannot guarantee the security of your personal information.

International data transfer

We are headquartered in the United States and may use service providers that operate in other countries. Your personal information may be transferred to the United States or other locations where privacy laws may not be as protective as those in your state, province, or country.

Users in Europe should also read the information provided about transfers of personal information to recipients outside Europe contained in the ‘Notice to European users’ below.

Children

The Site and Platform not intended for use by anyone under 18 years of age, except for the case of custodial accounts or accounts where an account holder is a parent or guardian that has added a child under 18 years of age as an authorized user. If you are a parent or guardian of a child from whom you believe we have collected personal information in a manner prohibited by law, please contact us. If we learn that we have collected personal information through the Site and/or Platform from a child without the consent of the child’s parent or guardian as required by law, we will comply with applicable legal requirements to delete the information.

Changes to this Privacy Policy

We reserve the right to modify this Privacy Policy at any time. If we make material changes to this Privacy Policy, we will notify you by updating the date of this Privacy Policy and posting it on the Site and Platform or other appropriate means. Any modifications to this Privacy Policy will be effective upon our posting the modified version (or as otherwise indicated at the time of posting). In all cases, your use of the Site and/or Platform after the effective date of any modified Privacy Policy indicates your acknowledging that the modified Privacy Policy applies to your interactions with the Site and/or Platform and our business.

How to contact us

● Email: privacy@drivewealth.com

● Mail: 28 Liberty Street, 50th Floor, New York, NY 10005

California Privacy Rights Notice

This section describes how we collect, use, and share Personal Information of California residents in our capacity as a Business under the California Consumer Privacy Act (“CCPA”), and such residents’ rights with respect to that Personal Information.

For purposes of this section, the terms “Personal Information,” “Sensitive Personal Information,” and “Business” have the respective meanings given in the CCPA, but Personal Information does not include information exempted from the scope of the CCPA, such as information subject to GLBA. Therefore, this section does not apply to personal information subject to GLBA, such as the personal information of Fully Disclosed California resident customers. For information about how we process personal information from U.S. customers who have created an account for purposes of seeking financial products or services from us to be used primarily for personal, family or household purposes, please review our U.S. Consumer Privacy Notice, available here. In some cases, we may provide a different privacy notice to certain categories of California residents, such as job applicants, in which case that notice will apply instead of this section.

Your California privacy rights. Under the CCPA, California residents have the rights to their Personal Information listed below. However, these rights are not absolute, and in certain cases we may decline your request as permitted by law. We may not be able to process your request if you do not provide us with sufficient detail to allow us to confirm your identity or to understand and respond to your request.

Information. You can request the following information about how we have collected and used your Personal Information during the past 12 months:

The categories of Personal Information that we have collected.

The categories of sources from which we collected Personal Information.

The business or commercial purpose for collecting, selling, or sharing Personal Information.

The categories of third parties to whom we disclose Personal Information.

The categories of Personal Information that we sold, disclosed, or shared for a business purpose.

The categories of third parties to whom the Personal Information was sold, shared, or disclosed for a business purpose.

Access. You can request a copy of the Personal Information that we have collected about you during the past 12 months.

Correction. You can ask us to correct inaccurate Personal Information that we have collected about you.

Deletion. You can ask us to delete the Personal Information that we have collected from you.

Opt-out. You can request to opt-out of disclosures of your Personal Information that constitute “selling” or “sharing” of your Personal Information.

Nondiscrimination. You are entitled to exercise the rights described above free from discrimination as prohibited by the CCPA.

Exercising your right to information, access, correction, and deletion. You may submit requests to exercise these rights using this webform or by email to privacy@drivewealth.com.

Exercising your right to opt-out of the “sale” or “sharing” of your Personal Information. While we do not sell Personal Information for money, like many companies, we may use services that help deliver interest-based ads to you as described above. Our use of some of these services may be classified under California law as “selling” or “sharing” your Personal Information with the advertising partners that provide the services. You can submit requests to opt-out of this “selling” or “sharing” using this webform, by emailing privacy@drivewealth.com, or by broadcasting the global privacy control signal. In addition, you can exercise your right to opt out of “selling” or “sharing” your Personal Information by selecting the opt out choice on our website. You will need to renew your opt-out choice if you visit our website from a new device or browser or if you clear your cookies because your opt-out choice will be linked to your browser only.

Consumers under 16. We do not have actual knowledge that we sell or share the Personal Information of California residents under 16 years of age.

Sensitive Personal Information. We do not use or disclose Sensitive Personal Information for purposes that California residents have a right to limit under the CCPA.

Verification of identity; Authorized agents. We may need to verify your identity in order to process your information, access, correction, or deletion requests and reserve the right to confirm your California residency. To verify your identity, we may require government identification, a declaration under penalty of perjury, or other information, where permitted by law.

Your authorized agent may make a request on your behalf upon our verification of the agent’s identity and our receipt of a copy of a valid power of attorney given to your authorized agent pursuant to California Probate Code Sections 4000-4465. If you have not provided your agent with such a power of attorney, you must provide your agent with written and signed permission to exercise your CCPA rights on your behalf, provide the information we request to verify your identity, and provide us with confirmation that you have given the authorized agent permission to submit the request.

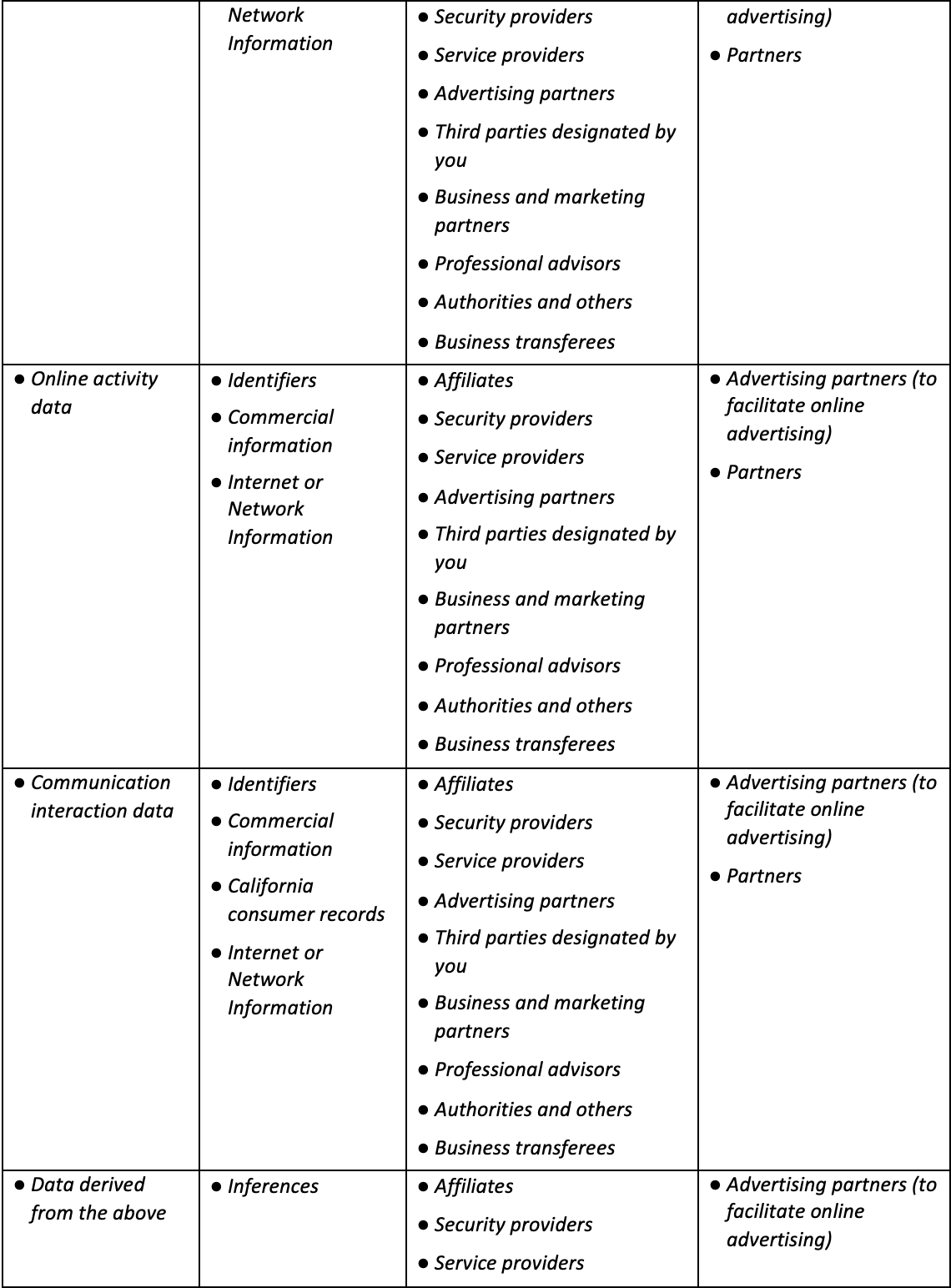

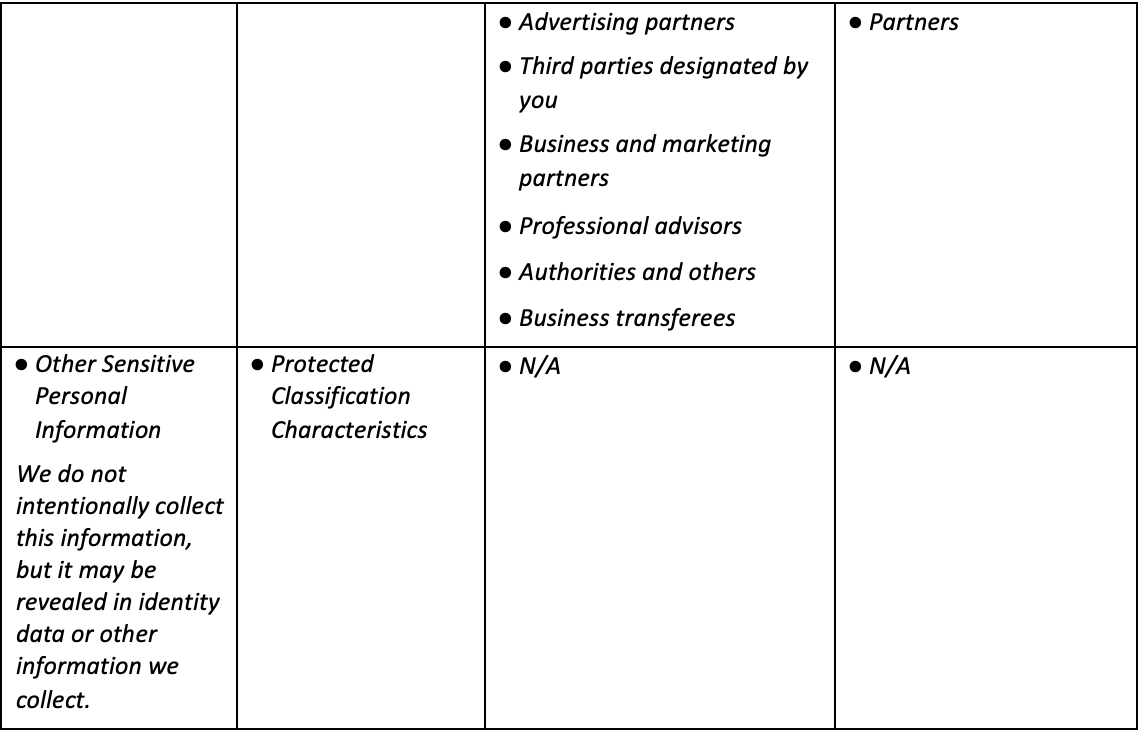

Personal Information that we collect, use, and disclose. We have summarized the Personal Information we collect and may disclose to third parties by reference below to both the categories defined in the “Personal information we collect” section of this Policy above and the categories of Personal Information specified in the CCPA (Cal. Civ. Code §1798.140) and described our practices currently and during the 12 months preceding the effective date of this Privacy Policy. Information you voluntarily provide to us, such as in free-form webforms, may contain other categories of personal information not described below.

Contact Us. If you have questions or concerns, please contact us using the contact details set forth in the How to contact us section, above.

Notice to European users

General

Where this Notice to European users applies. The information provided in this “Notice to European users” section applies only to individuals in the United Kingdom and the European Economic Area (i.e., “Europe” as defined at the top of this Privacy Policy).

Personal information. References to “personal information” in this Privacy Policy should be understood to include a reference to “personal data” as defined in the “GDPR” (i.e., the General Data Protection Regulation 2016/679 (“EU GDPR”)) and the EU GDPR as it forms part of the laws of the United Kingdom (“UK GDPR”). Under the GDPR, “personal data” means information about individuals from which they are either directly identified or can be identified. The personal information that we collect from and about you is described in greater detail in the section “Personal information we collect” that is set out above.

Controller. DriveWealth is the “controller” in respect of the processing of your personal information covered by this Privacy Policy for purposes of GDPR. See the How to contact us section above for our contact details.

Our GDPR Representatives. We have appointed the following GDPR representatives:

Our Data Protection Officer. We have appointed a “Data Protection Officer”, this is a person who is responsible for independently overseeing and advising us in relation to our compliance with the GDPR (including compliance with the practices described in this Privacy Policy). If you want to contact our Data Protection Officer directly, you can email: privacy@drivewealth.com.

Our legal bases for processing

In respect of each of the purposes for which we use your personal information, the GDPR requires us to ensure that we have a “legal basis” for that use.

Our legal bases for processing your personal information described in this Privacy Policy are listed below.

● Where we need to process your personal information in order to deliver the Site and/or Platform to you, or where you have asked us to take specific action which requires us to process your personal information (“Contractual Necessity”).

● Where it is necessary for our legitimate interests and your interests and fundamental rights do not override those interests (“Legitimate Interests”). More detail about the specific legitimate interests pursued in respect of each purpose we use your personal information for is set out in the table below.

● Where we need to comply with a legal or regulatory obligation, such as ‘Know Your Customer’ or Anti-Money Laundering laws (“Compliance with Law”).

● Where we have your specific consent to carry out the processing for the Purpose in question (“Consent”).

We have set out below, in a table format, the legal bases we rely on in respect of the relevant purposes for which we use your personal information – for more information on these purposes and the data types involved, see the ‘How we use your personal information’ section above and the description of associated data sharing relevant to such purposes set out in the ‘How we share your personal information’ section (also above).

Retention

We retain personal information for as long as necessary to fulfil the purposes for which we collected it, including for the purposes of satisfying any legal, accounting, or reporting requirements, to establish or defend legal claims, or for the ‘Compliance and protection’ purposes outlined above.

To determine the appropriate retention period for personal information, we consider the amount, nature, and sensitivity of the personal information, the potential risk of harm from unauthorized use or disclosure of your personal information, the purposes for which we process your personal information and whether we can achieve those purposes through other means, and the applicable legal requirements.

When we no longer require the personal information we have collected about you, we will either delete or anonymize it or, if this is not possible (for example, because your personal information has been stored in backup archives), then we will securely store your personal information and isolate it from any further processing until deletion is possible. If we anonymize your personal information (so that it can no longer be associated with you), we may use this information indefinitely without further notice to you.

Other Information

No obligation to provide personal information. You do not have to provide personal information to us. However, where we need to process your personal information either to comply with applicable law or to deliver our Site and/or Platform to you, and you fail to provide that personal information when requested, we may not be able to provide some or all of our Site and/or Platform to you. We will notify you if this is the case at the time.

No sensitive information. We ask that you not provide us with any sensitive personal information (e.g., information related to racial or ethnic origin, political opinions, religion or other beliefs, health, criminal background or trade union membership, or biometric or genetics characteristic other than as requested by us as part of the Site and/or Platform) on or through the Site and/or Platform, or otherwise to us. If you provide us with any such sensitive personal information to us when you use the Site and/or Platform, you must consent to our processing and use of such sensitive personal information in accordance with this Privacy Policy. If you do not consent to our processing and use of such sensitive personal information, you must not submit such sensitive personal information through our Site and/or Platform.

No Automated Decision-Making and Profiling. As part of our services, we do not engage in automated decision-making and/or profiling, which produces legal or similarly significant effects. We provide our analysis to our Introducing Firms and our Introducing Firms make decisions that may affect you.

Your rights

General. European data protection laws give you certain rights regarding your personal information. If you are located in Europe, you may ask us to take the following actions in relation to your personal information that we hold:

Access. Provide you with information about our processing of your personal information and give you access to your personal information.

Correct. Update or correct inaccuracies in your personal information.

Delete. Delete your personal information where there is no lawful reason for us continuing to store or process it. You also have the right to ask us to delete or remove your personal information where you have successfully exercised your right to object to processing (see below), where we may have processed your information unlawfully, or where we are required to erase your personal information to comply with local law. Note, however, that we may not always be able to comply with your request of erasure for specific legal reasons that will be notified to you, if applicable, at the time of your request.

Transfer. Transfer a machine-readable copy of your personal information to you or a third party of your choice, in certain circumstances. Note that this right only applies to automated information for which you initially provided consent for us to use or where we used the information to perform a contract with you.

Restrict. Restrict the processing of your personal information, if: (i) you want us to establish the personal information's accuracy; (ii) our use of the personal information is unlawful but you do not want us to erase it; (iii) you need us to hold the personal information even if we no longer require it as you need it to establish, exercise or defend legal claims; or (iv) you have objected to our use of your personal information but we need to verify whether we have overriding legitimate grounds to use.

Object. Object to our processing of your personal information where we are relying on legitimate interests as our legal basis, and there is something about your particular situation that makes you want to object to processing on this ground as you feel it impacts on your fundamental rights and freedom. You also have the right to object where we are processing your personal information for our promotional purposes.

Withdraw Consent. When we use your personal information based on your consent, you have the right to withdraw that consent at any time. This will not affect the lawfulness of any processing carried out before you withdraw your consent.

Exercising These Rights. You may submit these requests by contacting us. We may request specific information from you to help us confirm your identity and process your request. Whether or not we are required to fulfill any request you make will depend on a number of factors (e.g., why and how we are processing your personal information), if we reject any request you may make (whether in whole or in part) we will let you know our grounds for doing so at the time, subject to any legal restrictions. Typically, you will not have to pay a fee to exercise your rights; however, we may charge a reasonable fee if your request is clearly unfounded, repetitive or excessive. We try to respond to all legitimate requests within a month of receipt. It may take us longer than a month if your request is particularly complex or if you have made a number of requests; in this case, we will notify you and keep you updated.

Your Right to Lodge a Complaint with your Supervisory Authority. Although we urge you to contact us first to find a solution for any concern you may have, in addition to your rights outlined above, if you are not satisfied with our response to a request you make, or how we process your personal information, you can make a complaint to the data protection regulator in your habitual place of residence.

For users in the European Economic Area – the contact information for the data protection regulator in your place of residence can be found here: https://edpb.europa.eu/about-edpb/board/members_en

For users in the UK – the contact information for the UK data protection regulator can be found here: https://ico.org.uk/make-a-complaint/

Data Processing outside Europe

DriveWealth is a U.S.-based company and many of our service providers, advisers, partners or other recipients of data are also based in the U.S. This means that, if you use the Site and/or Platform, your personal information will necessarily be accessed and processed in the U.S. It may also be provided to recipients in other countries outside Europe.

Where we share your personal information with third parties who are based outside Europe, we try to ensure a similar degree of protection is afforded to it by making sure one of the following mechanisms is implemented:

Transfers to territories with an adequacy decision. We may transfer your personal information to countries or territories whose laws have been deemed to provide an adequate level of protection for personal information by the European Commission or UK Government (as and where applicable) (from time to time) or under specific adequacy frameworks approved by the European Commission or UK Government (as and where applicable) (from time to time), such as the EU-U.S. Data Privacy Framework or the UK Extension thereto.

Transfers to territories without an adequacy decision.

We may transfer your personal information to countries or territories whose laws have not been deemed to provide such an adequate level of protection (e.g., the U.S.).

However, in these cases:

we may use specific appropriate safeguards, which are designed to give personal information effectively the same protection it has in Europe – for example, standard-form contracts approved by relevant authorities for this purpose; or

in limited circumstances, we may rely on an exception, or ‘derogation’, which permits us to transfer your personal information to such country despite the absence of an ‘adequacy decision’ or ‘appropriate safeguards’ – for example, reliance on your explicit consent to that transfer.

You may contact us if you want further information on the specific mechanism used by us when transferring your personal information out of Europe.